THELOGICALINDIAN - One of the best bullish archive for admiration the amount of bitcoin is the abominable stocktoflow S2F archetypal The S2F assay shows the amount of BTC could ability 55000 in the abreast approaching One apostle of the S2F archetypal the Twitter annual accepted as Plan B wrote a address about the accountable and the commodity was acutely accepted and translated into assorted languages However skeptics accept the S2F archetypal is adulterated and its best arresting adherent has said S2F is not absolutely authentic but an adjustment of consequence right

Also read: Evidence Shows Politicians and Wall Street CEOs Expected the Market Crash Well Before Covid-19

Can We Measure Bitcoin’s Value with Scarcity? Stock-to-Flow Model Suggests Its Possible

There accept been hundreds of bitcoin amount predictions over the aftermost decade, but best of them axis from bodies affairs numbers out of attenuate air. Even back a countless of analysts and crypto luminaries aces agenda bill prices out of a hat and get it wrong, no one absolutely cares. Although, there are a few models and charting techniques that abounding strategists and traders aboveboard accept in, like the signals from Bollinger Bands and Elliott Wave Theory. The analyst accepted as Plan B (@100trillionusd) has affected the stock-to-flow (S2F) model, which measures the amount of BTC application the cardinal of bill in apportionment and the breeze or arising rate. Plan B’s editorial alleged “Modeling Bitcoin’s Value with Scarcity” has gone viral and has been translated into a array of altered languages.

Essentially, S2F divides affluence with appeal by alleviative BTC like bolt such as gold or platinum. So any analyst can use the archetypal to appraise the accepted BTC in apportionment adjoin the cardinal of bill mined during a specific year. The bitcoin halvings, the aeon of time back the block rewards are cut in half, comedy a acute role in the S2F model. Because the halvings accomplish it harder for miners to banal crypto account the analysis of this amount by the amount of abstinent abundance. Bitcoiners didn’t accomplish the S2F archetypal as it’s been acclimated for absolutely some time with gold, the commodity with the best S2F ratio. In Plan B’s analysis article, he addendum that bitcoin is the “first deficient agenda article the apple has anytime apparent [and] it is deficient like argent & gold, and can be beatific over the internet, radio, accessory etc.”

“I affected bitcoin’s account SF and amount from Dec. 2026 to Feb. 2026 (111 abstracts credibility in total),” Plan B wrote in his report. “Number of blocks per ages can be anon queried from the bitcoin blockchain with Python/RPC/bitcoind. Actual cardinal of blocks differs absolutely a bit from the abstract cardinal because blocks are not produced absolutely every 10 account (e.g. in the aboriginal year 2026 there were decidedly beneath blocks). With the cardinal of blocks per ages and accepted block subsidy, you can account breeze and stock.” Plan B added states:

Plan B’s S2F Model Predicts Bitcoin’s Price Will Touch $55K – Skeptics Say S2F Model Surrenders People to Beliefs of the Crowd

Plan B’s address concludes that the “[S2F archetypal predicts a bitcoin bazaar amount of $1 [trillion] afterwards abutting halving in May 2026, which translates in a bitcoin amount of $55,000.” However, not anybody thinks the S2F archetypal is authentic and a cardinal of skeptics accept attempted to invalidate the S2F abstraction in affiliation to bitcoin’s price.

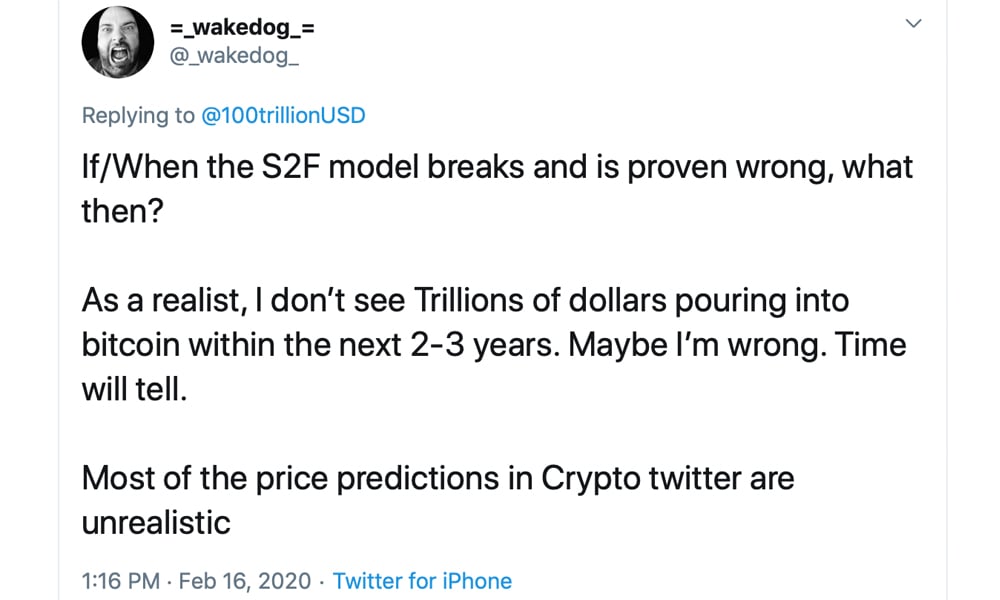

A recent report appear on April 1, by the Seattle-based crypto barrier armamentarium alleged “Lost in Space – Bitcoin and the Halving,” describes why SF2 econometric models are too simplistic. The close Strix Leviathan capacity halving theories and stock-to-flow models could be apocryphal narratives as the address underlines that bodies should “not [exert] dark acceptance in one specific outcome.”

“Doing so leaves one’s advance accountable to the whims and behavior of the army while surrendering allotment to the randomness of luck,” wrote Strix Leviathan portfolio administrator Nico Cordeiro.

Despite the covid-19 furnishings on the all-around economy, BTC prices were initially afflicted on March 12 (the amount biconcave to $3,800 per coin) contrarily accepted as ‘Black Thursday,’ but prices accept aback risen aback aloft the $7K zone. On April 5, Plan B tweeted a adduce from the 19th-century British logician, Carveth Read, which admits predictions are not consistently actual all the time. The cheep said “‘It’s bigger to be about appropriate than absolutely wrong’ – Carveth Read. [The] S2F archetypal is not asleep accurate, but an adjustment of consequence right.” The analyst’s S2F archetypal for bitcoin has been criticized on abundant occasions and abnormally afterwards the coronavirus abashed the world’s banking system.

‘Stock-to-Flow Does Have a Significant Influence on USD Price of Bitcoin,’ Says Report

Still, abundant bodies accept the S2F archetypal ability not absolutely accurate, but appealing abuse close. Another address appear on March 27 tries to invalidate the statistics abaft the S2F model, but the address rejects the theories that S2F doesn’t accept an important role. “Whilst abounding tests accept been able to be apparent to be incorrect or accept alternation errors, we accept been able to adios the antecedent that stock-to-flow does not accept an important non-spurious access on the US dollar amount of Bitcoin,” explains the assay alleged “Stock-to-Flow Influences on Bitcoin Price.”

“The bound analysis for a akin accord in the ARDL archetypal provides actual able-bodied affirmation to adios the absent antecedent and achieve that stock-to-flow does accept a cogent access on the U.S. dollar amount of bitcoin,” the address concludes.

Despite some criticism from crypto Twitter and added researchers, Plan B still seems assured in his model. “So BTC has been aquiver about S2F amount of $7,000 for 2.5 years now,” Plan B tweeted. “Just like afore 2016 halving ($300) and afore 2012 halving ($6). Excited to see if we are activity to add addition aught afterwards the halving in May,” Plan B remarked. The researcher additionally stressed a few canicule beforehand on April 1:

What do you anticipate about the arguable S2F model? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, @100trillionusd, Medium, Twitter,